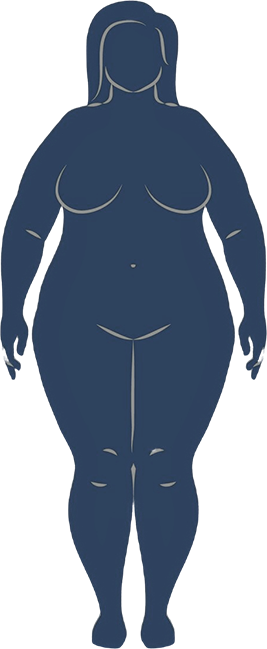

Lipedema Insurance coverage for lipedema surgery has become more attainable recently.

Prior to then, insurance was usually denied because it was considered a cosmetic procedure.

-

Conditions or symptoms are present in all the following:

Pain in affected areasBruise easilyWeight loss efforts do not show any improvement in affected areasSwelling in limbs

-

In-person medical examination by Dr. Byrd to confirm evidence of the disease. Photographs must be submitted along with the findings. All the following must be submitted::

Bilateral symmetric adiposity (fat accumulation) in the affected extremitiesTenderness and nodularity of fat deposits in lipedema affected areas, such as dimpled or orange peel texture.Non-pitting edemaNegative Stemmer sign. To do a Stemmer test, try to pinch and lift a skinfold at the base of the second toe or middle finger. If you can pinch and lift the skin, Stemmer’s test is negative.

- Physical function impairment involving the ability to walk or perform activities of daily living.

- Individual must respond to at least three consecutive months of medical management. You must document the conservative measures you took during this period, showing that you have not responded to the medical management.

- File for pre-authorization before you have surgery.